Banks in the country have reportedly lost over N9.5 billion so far in 2023, according to the Nigeria Inter-Bank Settlement System.

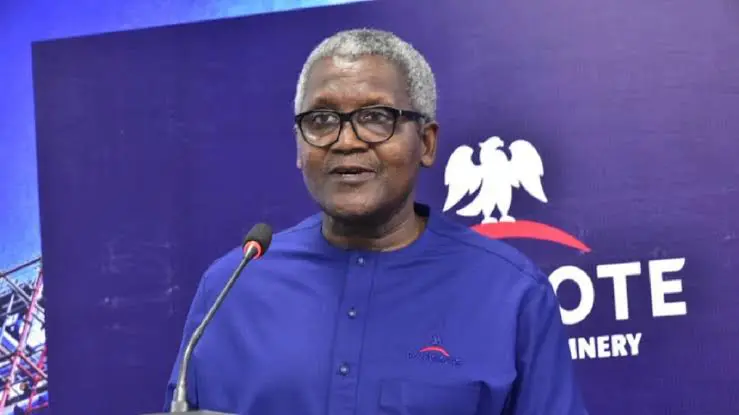

The managing director of NIBSS, Premier Owoih, said this at the third-quarter meeting of the Nigeria Electronic Fraud Forum, which was held in Lagos.

The MD, represented by Temidayo Adekanye, the NIBSS Chief Risk Officer, raised concerns about the alarming rise in electronic fraud in the country’s financial sector, particularly in the online gambling business.

He pointed out that the CBN’s cashless strategy is partly to blame for the rise in e-fraud in the banking sector.

He claimed: “Recently, the CBN implemented cashless policies, which had a dramatic impact on the number of transactions in the sector and a variable influence on the amount of fraud in the sector itself.

“Now, the enhanced efficiency has also resulted in a sharp rise in fraud throughout the business. The total amount of fraud reported during the first quarter of 2023 was N5.1 billion.”

The MD went on to emphasize how critical the issue has grown to the stability of the financial industry by comparing data on e-fraud from prior years to 2023.

“For fraud trends over the last five years, we were looking at about N3 billion in 2019, and currently 2023, we are looking at about N9.5 billion,” he said.

“So, as you can also see from the current perspective, from January to July 2023, there has been a minor increase between June and July, a 39% increase with 8,649; with the actual fraud losses in July 2023, we’re looking at N1.2 billion; this is a 54% increase over the period.

Now, as you can see from January overall, we had actual fraud losses of roughly N2.7 billion.

According to Mr. Adekanye, the most efficient tools fraudsters use are betting platforms, wallet accounts, or point-of-sale agents. These platforms are almost untraceable.

He demanded that more POS agents, cryptocurrency accounts, sports betting accounts, and other entities be verified and identified as the recovery rate of e-fraud across these mediums hovers around 5% nationally.

The NeFF Chair, who also serves as the CBN’s Director of Payment System Management Financial institutions, according to Musa Jimoh, has no choice but to fight cybercriminals since they have the power to bring down the entire financial system.

He urged greater awareness and education, noting that as more people use the financial system and the number of transactions rises, there would be more opportunities for vulnerability that criminals might take advantage of.