Banks are required by the Central Bank of Nigeria to set aside earnings from foreign exchange revaluation as a safety net against impending economic shocks.

According to Vanguard, in this case, the regulator forbade banks from using foreign exchange revaluation gains to pay dividends or cover operating costs.

This information was provided by the apex bank in a letter dated September 11, 2023, to all banks with the subject line “Impact of Recent FX Policy Reforms: Prudential Guidance to the Banking Sector.”

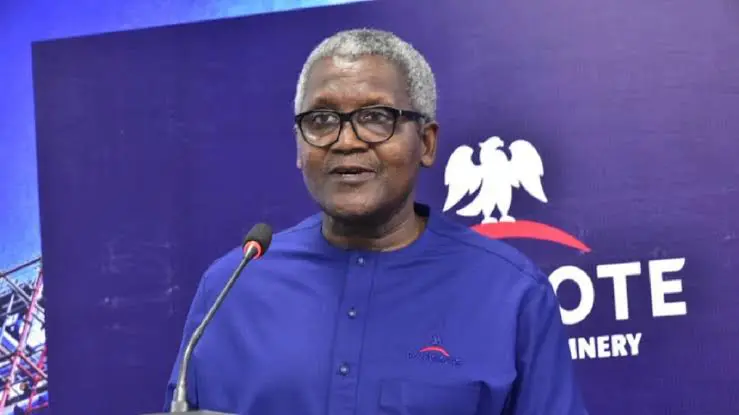

“The CBN has reviewed the impact of the recent foreign exchange rate regime change on the banking system and observed its potential to significantly increase naira values of banks’ foreign currency assets and liabilities, resulting in varying levels of FX revaluation gains or losses across the industry,” according to a letter signed by the Director of the CBN’s Banking Supervision Department, Mr. Haruna Mustafa.

“Additional effects of the FX policy adjustments could be violations of the single obligor and net open position restrictions, a potential rise in asset quality issues, and pressure on the industry’s capital adequacy.”

The bank subsequently adopted the following prudential recommendations and instructions for banks to implement right away:

Treatment for FX Revaluation Gains: Banks must use extreme caution and lay aside the FCY revaluation gains as a counter-cyclical buffer to cushion any future adverse movements in the FX rate.

“In this regard, banks are forbidden from using these FX revaluation gains to cover operating costs or pay dividends.

“Single Obligor Limit: Upon application to the CBN, banks that unintentionally exceed the Single Obligor Limit due to the FX policy would be granted forbearance.”

It also added that only facilities that already existed as of the policy’s effective date shall be subject to the forbearance and such banks must not be subject to regulatory deductions on amounts in excess of the SOL limit when calculating their CAR.

“Banks that exceed the Net Open Position prudential restrictions as a result of the foreign exchange revaluation may request forbearance from the CBN.

“Banks are urged to strengthen capital buffers to increase resistance to potential economic or volatile shocks.”

Lastly it stated that the CBN will keep an eye out for new vulnerabilities and implement necessary regulatory changes.