Brent oil’s price stayed steady at $94.30 per barrel on Monday, September 18, at 5:14 AM (GMT+1), according to an analysis of the global petroleum market’s movements using data from Oil Price.

The Times reported that Brent’s price fluctuated over the previous weekend between $93 and $94 per barrel, illuminating a minor market movement.

There have been growing worries about a possible oil supply deficit, which is what has caused the recent spike in crude oil prices.

Saudi Arabia and Russia, two major participants in the oil market, have pledged to maintain output curbs throughout 2023.

It is worth noting that China recently took a crucial step after experiencing an economic downturn that damaged oil demand.

In a move that is anticipated to boost oil demand, China’s central bank announced an increase in lending capacity for individuals and enterprises.

Despite this, market participants continue to watch for new information that can provide a thorough knowledge of China’s economic environment and its possible effects on oil demand.

The four crude export terminals that were initially closed for many days – Brega, Ras Lanuf, Es Sider, and Zueitina – were reopened last week, they claim, despite the impact of the severe storm.

The Organization of the Petroleum Exporting Countries presented information about the oil demand outlook for 2024 in its most recent monthly oil market report.

The analysis projects a significant increase in global oil demand of 2.25 million barrels per day, highlighting a quickening of economic growth in major economies.

Even in the face of elevated interest rates and ongoing inflation, this estimate is still solid. Notably, the analysis projects 2.6% increase in global GDP in 2024, underscoring the strong economic momentum that is predicted to support rising oil demand.

Nigeria is very concerned about the rise in the price of crude oil on the world market. The country must purchase refined petroleum products at exorbitant prices because it is an oil-exporting nation without functional refineries.

This will unavoidably put pressure on the cost of petrol and diesel at the gas stations.

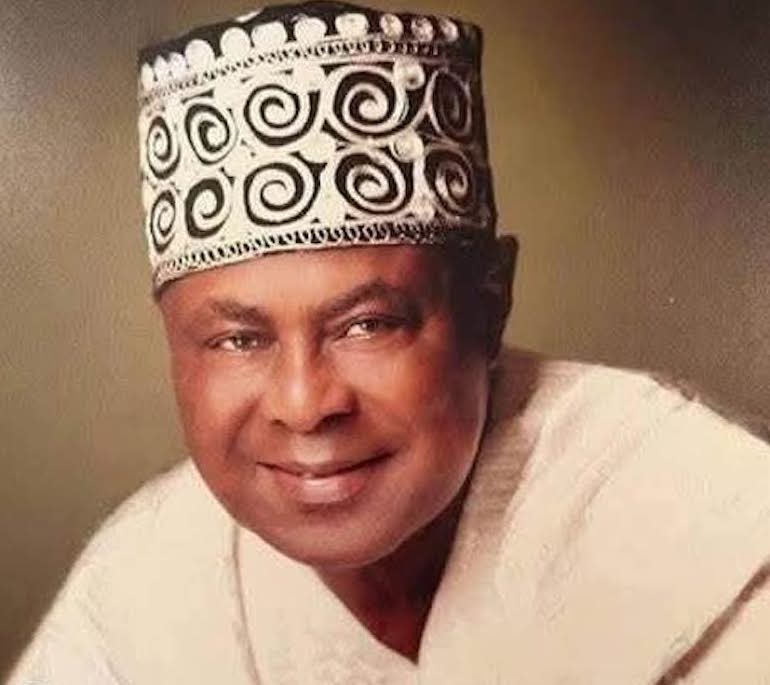

According to the Chairman of the Crude Oil Refineries Association of Nigeria, Momoh Oyarekhua, in a July 2023 interview, the government and various energy stakeholders in the country are not providing the necessary assistance to modular refineries.

Mr. Oyarekhua noted that strong government backing for modular refineries may significantly reduce a variety of costs. These would include the expenses related to exporting crude oil for refinement and importing the finished goods.

According to Oyarekhua, “We have argued that modular refineries must purchase crude oil in Naira because, when we process crude, we would sell it on the domestic Nigerian market and our income is in Naira; thus, the feedstock should also be in Naira so we do not overcrowd the FX market.

“If we need to buy comparable USD in the market to pay for oil, with an average price of $100 per barrel, and we have 40 modular refineries with 10,000 barrels per day capacity, we will need at least $30 million every month to buy crude. At the end of the day, we will need around 360 million to buy crude oil in a year.”