The Nigerian Securities and Exchange Commission has approved NASD Plc’s launch of its Digital Securities Platform, powered by Blockstation, under the Regulatory Incubation Program.

The Times reported that the NASD in a press statement stated that this follows the Central Bank of Nigeria lifting of the ban on trading in digital assets, which represents a significant step towards fostering a new age of innovation that enhances transparency and deepens trust and inclusion in Nigerian capital markets.

The NASD, along with Blockstation Incorporation, had worked with the SEC to develop a regulatory framework for crypto and digital assets.

“Our goal is to provide access to promising digital assets to millions of young investors, allowing them to make purchases with confidence in a completely compliant and secure investment environment.”

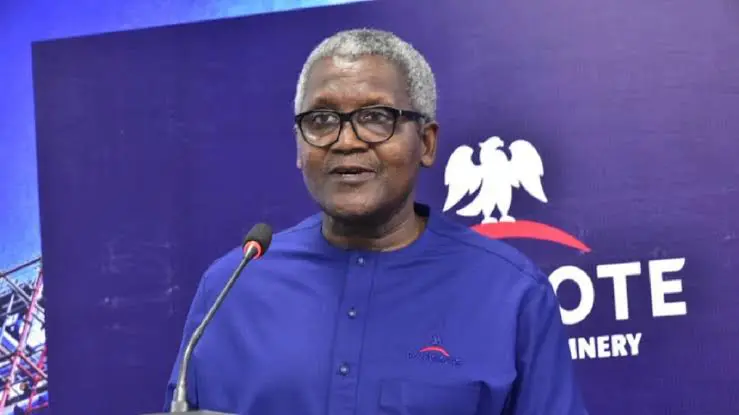

“Nigeria presently ranks second in the world in terms of blockchain wallets, and our Exchange is ready to support high-quality assets that thrive on the blockchain,” the Managing Director of NASD Plc, elaborated.

Longe remarked that the NASD is pioneering a new way for issuers to obtain funds from the public through the use of digital assets.

He went on to say that this attempt will have a direct impact on traditional debt and equities markets, as well as traditional illiquid assets.

“Our goal is to provide access to promising digital assets to millions of young investors, allowing them to make purchases with confidence in a completely compliant and secure investment environment.”

According to him, the prospect for digital sovereign bonds might supply the necessary financing for projects while also assisting the country’s FX difficulties.

Longe claimed that with $20 billion in annual remittances, the diaspora has a good window to invest their money back home.

He mentioned that tokenizing entertainment assets like publishing rights might further empower and commercialize the world’s largest film content creators.

He stated that because Nollywood is currently undercapitalized, new markets such as tokenized real estate and mortgage-backed securities might use tokenization to address such difficulties, such as the 28 million housing gap, generating a significant market potential.

“Our goal is to provide access to promising digital assets to millions of young investors, allowing them to make purchases with confidence in a completely compliant and secure investment environment.

The application of cutting-edge technology to meet the requirements of and captivate a sizable young population is poised to open up hitherto unexplored areas.

“We are confident that this platform will play a critical role in propelling Nigeria into a new era of economic growth and development,” says Blockstation CEO, Jai Waterman.

Blockstation, as a technological partner, has created a solid business blockchain-driven platform, creating and popularizing the necessity of regulated tokenized IPOs, also known as Security Token Offerings.

The N-DSP is poised to revolutionize the way digital securities are issued, traded, and settled, democratizing access to capital markets, and leveraging blockchain technology to enhance accessibility while minimizing costs.

The SEC will regulate the N-DSP’s operations during the RI Program, and participating institutions such as custodians, brokers, and issuing houses will play critical roles during this period.

A consortium of partners, including NASD Plc, Blockstation, Sophus Consulting, and TK Tech Africa, will facilitate it.

This sandbox will include a small number of qualified issuers, indicating a targeted approach to more controlled and effective adoption.