The Association of Issuing Houses of Nigeria has stated that N3.44 trillion was raised through corporate bonds and commercial paper issuance by private enterprises and government entities.

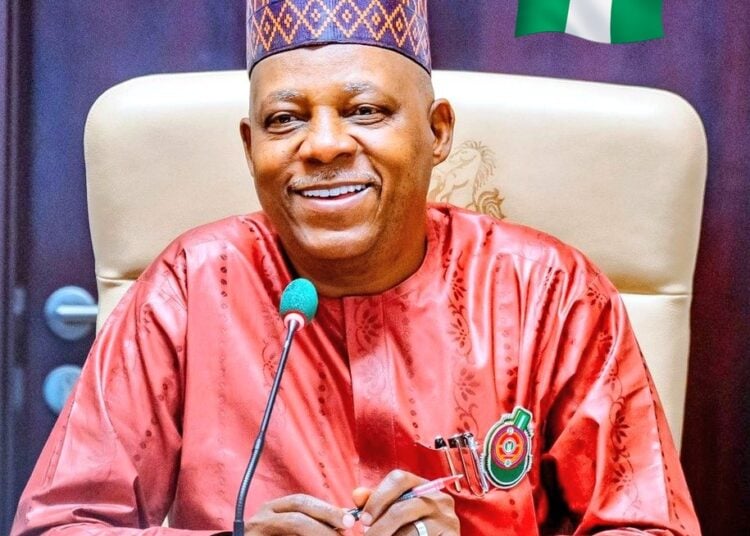

According to The Punch, this statement was made by AIHN President, Ike Chioke on Tuesday in Lagos during the organization’s annual general meeting and the presentation of the 2022 annual report.

He listed the group’s financial standing as of December 2022 and stated that during the previous three years, revenue had climbed by 31%.

According to his statement, “Local environment capital raising activities built upon the achievements documented in 2021.” Notably, over the past two years, 333 trades in the local debt market with a combined value of over N3.44 trillion have been recorded. This mostly illustrates the activities of corporates in the bonds and commercial paper issuance space while also considering states-sponsored instruments,” he said.

Chioke continued by saying that the group’s total assets in 2022 were N416 million, indicating a rise from the N361 million reported in the 2021 fiscal year.

“Compared to N65 million in 2021, it recorded a total income of N85 million in 2022. Additionally, the group’s 2022 income surplus of N54 million exceeded the N36 million it reported for the 2021 fiscal year, he said.

According to Chioke, the expansion demonstrates the company’s dedication to resource efficiency and budgetary discipline.

He stated that despite national and international macroeconomic obstacles, the market’s investment banking segment reached this milestone in 2022.

He continued, “As many economies continue to recover from the impact of Covid-19, the sector sustained the momentum seen in 2021.”

According to Chioke, Dangote Industries Limited successfully completed the N188 billion Series 1 dual-tranche bond issue as part of its N300 billion bond issuing strategy in August 2022.

“The issuing of the Series 2 bond, which has a maximum face value of N112 billion, came next in December 2022. This is the biggest corporate bond that the Nigerian capital market has ever seen.

“In September 2022, MTN Nigeria Communications Plc released its N115 billion Series 1 Bond as part of a N200 billion token issuing program. This is the first time a Nigerian telecom company has issued bonds,” he remarked.

“In May 2023, the Lagos State Government will issue its Series 1 N115 billion and Series 2 N19.82 billion bonds under the recently formed N1 trillion Debt and Hybrid Instruments Issuance Programme. These transactions, among many others, further demonstrate the growing trust that businesses and investors have in our local capital market,” he said.

He claimed that in 2022, the fixed-income market and global debt levels were affected by stricter monetary policies and poor growth forecast.

In the fourth quarter of 2022, global public and private debt-to-gross domestic product ratios remained considerably above pre-pandemic records, he continued, despite the fact that the volume of debt decreased by 2.2% year over year to $296.6 trillion.

As Chioke’s two-year term as president came to an end, the AIHN also used the AGM occasion to name Kemi Awodein as the next president.

Awodein promised in her acceptance speech to try her hardest to live up to the group’s confidence in her and the other members of the executive committee.

“We’ll proceed from the point when Ike Chioke dropped the barton. We’ll keep pushing the market’s development forward at breakneck speed. In order for us to boost the market as a group, I ask for your collective assistance,” she said.