Nigeria’s latest Eurobond offer has been oversubscribed at $9.1 billion, marking a successful return to the international bond market after a two-year hiatus and signaling potential investor confidence in the country’s economy.

The dual-tranche Eurobond was issued under Nigeria’s Global Medium Term Note Programme to finance the 2024 fiscal deficit.

Despite the oversubscription, with bids exceeding $9 billion, the federal government ultimately raised $2.2 billion from both bonds.

The federal government sold $700 million of a 6.5-year Eurobond maturing in 2031, with a coupon rate of 9.625%, and $1.5 billion of a 10-year Eurobond at a coupon rate of 10.375%.

This marked a significant step in Nigeria’s efforts to tackle its increasing fiscal deficit, with the funds raised primarily aimed at supporting the country’s 2024 budget, which is under strain due to ongoing revenue shortfalls and rising public spending.

The bonds were issued under the Regulation S/144A structure, allowing access to both US and international investors.

In a statement on Monday, the Debt Management Office announced the successful issuance of the Eurobonds, noting that the bonds attracted a diverse group of investors from various regions, including the United Kingdom, North America, Europe, Asia, the Middle East, and Nigerian investors.

“The Federal Republic of Nigeria successfully priced $2.2 billion in Eurobonds maturing in 2031 (6.5-year) and 2034 (10- year) in the international capital markets on 2 December 2024, with $700 million and $1.5 billion placed in the 2031 and 2034 maturities, respectively.

“The notes were priced at a Coupon and Re-offer Yield of 9.625 per cent and 10.375 per cent, respectively. Nigeria is pleased to have attracted a wide range of investors from multiple jurisdictions including the United Kingdom, North America, Europe, Asia, Middle East and participation from Nigerian investors.

“This it views as an expression of continued investor confidence in the country’s sound macro-economic policy framework and prudent fiscal and monetary management.

“The transaction attracted a peak orderbook of more than $9.0 billion. This underscores the strong support for the transaction across geography and investor class.

“With respect to investor class, demand came from a combination of Fund Managers, Insurance and Pension Funds, Hedge Funds, Banks and other Financial Institutions,” it stated.

DMO’s Director General, Patience Oniha, celebrated the milestone, highlighting strong investor demand and reaffirming the DMO’s commitment to transparency and ongoing engagement with investors.

The DMO also stated that the notes would be listed on the UK Listing Authority’s official list and available for trading on the London Stock Exchange’s regulated market, FMDQ Securities Exchange Limited, and the Nigerian Exchange Limited.

“The proceeds from this Eurobond issuance will be used to finance the 2024 fiscal deficit and support the government’s budgetary needs,” DMO said.

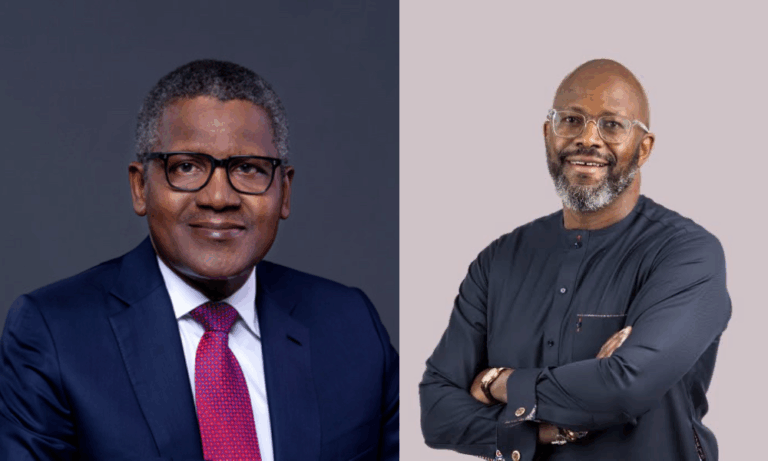

Meanwhile, Finance Minister Mr. Wale Edun, in his reaction, emphasized the confidence in President Bola Tinubu’s administration’s efforts to stabilize the Nigerian economy and promote sustainable growth.

He noted the strong investor interest in the Eurobonds as a sign of growing confidence in Nigeria’s economic direction.

“The broad range of investor appetite to invest in our Eurobonds is encouraging as we continue to diversify our funding sources and deepen our engagement with the international capital markets,” he said.

In his remark, the Governor of the Central Bank of Nigeria, Olayemi Cardoso, described the positive outcome as a reflection of investor confidence and Nigeria’s improved liquidity and market access.

Nigeria is making its return to the international capital markets after more than two years with this significant offering.

The Eurobond sale is being managed by a consortium of international and domestic financial institutions, including Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co., and Standard Chartered Plc, with Chapel Hill Denham Advisory Limited serving as the Nigerian bookrunner.