Christin George

Titan Trust Bank has blasted the Central Bank of Nigeria investigator, Jim Obazee-led panel over the report of the apex bank’s activities.

The new generation bank claimed that there was no fraud in the acquisition of Union Bank.

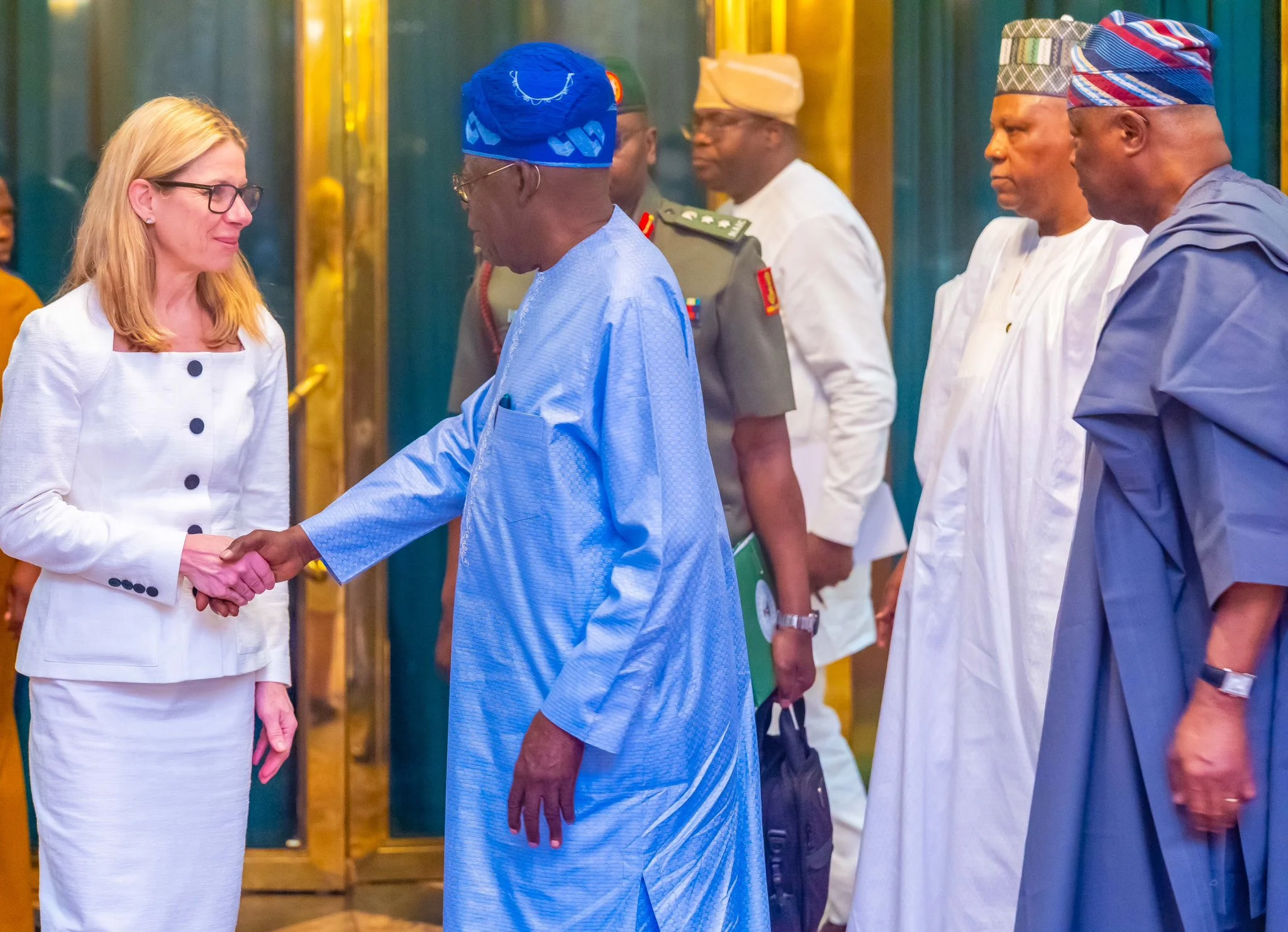

Recall that the Obazee-led panel had, on Wednesday, submitted the report of investigations into the acquisition of Union Bank and Keystone Bank to President Bola Tinubu in two separate letters dated December 20, 2023.

The report of the special investigation had accused Emefiele, of using proxies to acquire Union Bank for Titan Trust Bank Limited, as well as Keystone Bank without any evidence of payment. In his letters to the president, Obazee said he had completed his investigation into the illegal acquisition of Union Bank by Titan Bank, and was on the verge of recovering the two banks for the federal government.

“We were able to secure some documents and investigation reports will lead to the forfeiture of the two banks to the federal government. We have completed our investigation on this acquisition and have also held meetings with the relevant parties except for Mr. Cornelis Vink, who is currently hospitalised in Switzerland.

“Otherwise, we are on the verge of recovering these two banks for the federal government,” Obazee reportedly said. But in a swift reaction, Titan Trust Bank said in a statement issued yesterday from its Corporate Communications Department that the acquisition was conducted in the most professional, open, and transparent bidding process.

It added that the deal was funded by a combination of debt of $300 million and an additional equity injection of about $190 million, which was contributed by TTB’s two major shareholders – Magna International DMCC and Luxis International DMCC.

Besides, TTB noted that it sought and obtained all necessary regulatory approvals from its primary regulator – the CBN, the Securities and Exchange Commission, the Nigerian Exchange Limited, and the Federal Inland Revenue Service, among others. Following TTB’s acquisition of 93.41 per cent controlling interest in Union Bank on June 1, 2022, the statement noted that a change in control was effected with the dissolution of the former board and the reconstitution of a new board with a new leadership.

“The attention of the board and management of Titan Trust Bank Limited has been drawn to the widely circulating report of the special investigation into the activities of the CBN wherein, among other things, an allegation of illegal acquisition of Union Bank of Nigeria Plc by Titan Trust Bank Limited has featured prominently.

“We are aware that our customers, shareholders, employees, and other stakeholders of the two banks will naturally be troubled by this allegation,” the bank stressed.

Consequently, TTB said it was important to clarify the goings-on to set the records straight. It recalled that on December 18, 2021, it signed a Share Sale and Purchase Agreement with Atlas Mara Limited, Union Global Partners Limited, Emeka Emuwa, Standard Chartered Bank, and Montane Partners West Africa Limited, among others, according to ThisDay.

According to the acquiring bank, the bulk shareholders together owned 93.41 per cent of Union Bank’s issued ordinary share capital. The SPA, it said, was the product of a long and tortious due diligence process that involved leading financial and technical advisers.

“Titan Trust Bank engaged reputable firms like PricewaterhouseCoopers Limited for the financial due diligence, Drey Law Practice for the legal due diligence, Norton Rose Fulbright UK as Legal Advisers and Citibank London as Financial/Transaction Advisers.

“The bulk shareholders engaged a prominent UK Law firm, White & Case, as their Legal Advisers on the transaction. The acquisition was conducted in the most professional, open, and transparent bidding process,” it maintained.

The bank noted that the Certificates of Capital Importation for both the debt and the equity financing evidencing the receipt of the funds into Nigeria by legal means had been made available where requested.

In addition, the management of Titan Bank said that the $300 million acquisition facility was sourced from Afreximbank and was priced with a margin of 6.25 per cent and a moratorium period of 30 months.

TTB explained that it had paid interest on the loan for three interest periods, that is, 18 months so far.

“TTB sought and obtained all necessary regulatory approvals from its primary regulator – the CBN, SEC, NGX, and FIRS, among others,” the bank insisted.

Following TTB’s acquisition of 93.41 per cent controlling interest in Union Bank on June 1, 2022, a change in control, it stressed, was effected with the dissolution of the former board and the reconstitution of a new board with new leadership.

“TTB proceeded to conduct a Mandatory Takeover Offer, which was legally triggered by the acquisition of 93.41 per cent of Union Bank by TTB, bringing the percentage float of Union Bank shares to less than 20 per cent.

“The purpose of the MTO was to give the minority shareholders the opportunity to offer their shares on the same terms as was offered to the bulk shareholders. The MTO was conducted after all due regulatory approvals were obtained,” it added.

Furthermore, it explained that the slow pace of TTB’s acquisition and ultimate merger with Union Bank had been because of TTB and the regulators’ determination to ensure that the process remained fully compliant with extant laws, met best global practices, and was conducted in an open and transparent manner.

During the special investigation, the board and management of TTB and Union Bank, the statements said, had made all representations to the investigation team.

“There is no illegality or fraud in the acquisition as alleged. We insist that this acquisition can vie for one of the most professional and transparent in the history of this country,” TTB said.

On allegations relating to the ownership of TTB, it stated that the board and management provided the special investigators with the share ownership structure in TTB, including the holdings of Magna International DMCC and Luxis International DMCC owned by Mr Rahul Savara and Mr Cornelius Vink.

“These individuals are prominent global entrepreneurs and have thriving businesses in Nigeria and several countries around the world. The shareholding structure is also verifiable at the Corporate Affairs Commission.

“Therefore, we urge our customers, shareholders, and stakeholders to remain calm as we do everything legal to ensure that the current misunderstanding is clarified,” the bank said.